Next-gen cloud-native wealth management technology

Create digital wealth management products with WealthOS’ modular middle and back-office software-as-a-service (SaaS).

What sets us apart

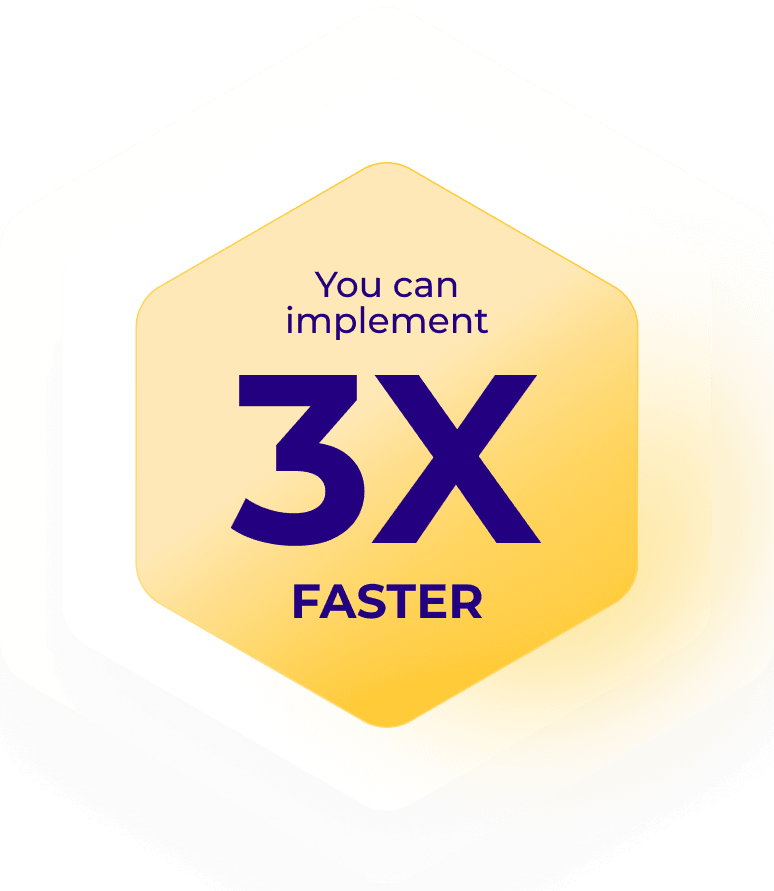

Accelerate your time-to-market and customer growth

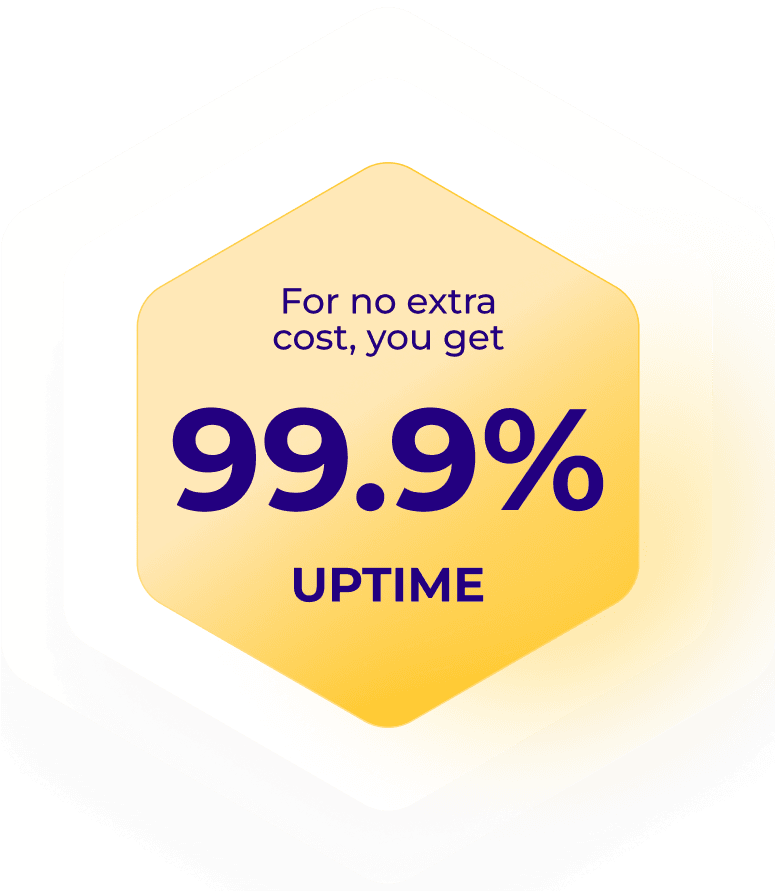

Cloud-native infrastructure

Enterprise-grade cloud security and built-in infrastructure maintenance (including upgrades) help you scale with ease.

Learn more

Microservices architecture

API-wrapped modules that are your building blocks for quickly assembling, testing, and deploying digital wealth products.

Learn more

Automated and orchestrated workflows

Reduced change management, maintenance, and service costs, freeing up your resources for client acquisition and growth.

Learn more

Marketplace for third-party integrations

Prebuilt no-code integrations that connect to specialised software and avoid integration maintenance help expand your ecosystem.

Learn more

What’s in it for you

Focus on what makes you different.

We will do the rest.

Focus on what makes you different.

We will do the rest.

Case study

Technology 5 mins to read