By Vindya Wickramasinghe Posted on 18.01.2024

How does a faster, automated pension transfer process with continuous client updates sound to you? We built our Unified Transfer Manager solution to support Pension providers to do just this. Read on to find out more!

UK pension transfers are often criticised for being “slow and opaque”1, taking weeks, or even months, depending on the provider’s technical capabilities2. Savers may often have difficulty tracking their transfer progress or getting updates from their Pension providers.

We believe the portability of individual DC pension pots is vital to building and retaining trust in the pensions sector. A person may transfer pensions from one provider to another due to lower charges, to access a wider range of investments, or to enjoy a better digital experience. Therefore, we built the Unified Pensions Transfer Manager so Pension providers can help people get the maximum out of their pension savings.

What is getting in the way of a great transfer experience?

Slow transfer times

The primary reason for slow transfer times is that the transfer process is largely manual and paper-based.

After receiving the instruction Pension providers have to:

- manually note the back-and-forth communication between the ceding provider and receiving provider for information gathering;

- manually carry out the due diligence process;

- manual fund transfers between providers–transferring funds by the ceding provider, receiving funds by the acquiring/receiving provider and then investing the funds; all of which can take a considerable amount of time.

Lack of client updates

Clients often complain about the lack of updates they receive on the progress of their pension transfer. This can be frustrating and stressful, especially for clients who are close to retirement. Pension providers often cite the complexity of the transfer process as the reason for the lack of updates. Undoubtedly, when following a manual, paper-based process, providing continuous updates will only add to the workload and lead to further delays.

How can we help?

A.k.a technology to the rescue

Industry adoption of technology has been slow and sporadic. While solutions exist for issues like trusted communication between pension providers, the lack of connectivity between different systems involved in the overall pension transfer process causes many issues to go unaddressed.

WealthOS’ Unified Transfer Manager looks at solving these key inefficiencies within a single system:

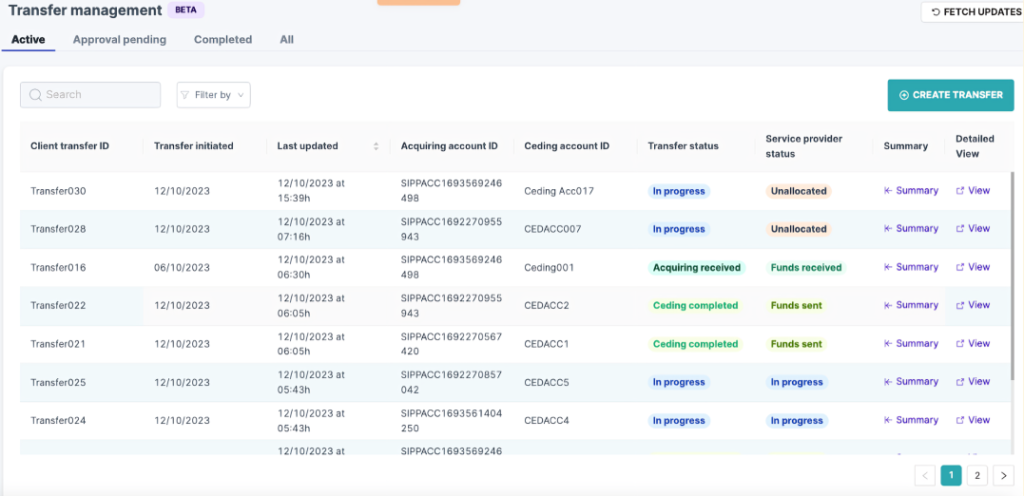

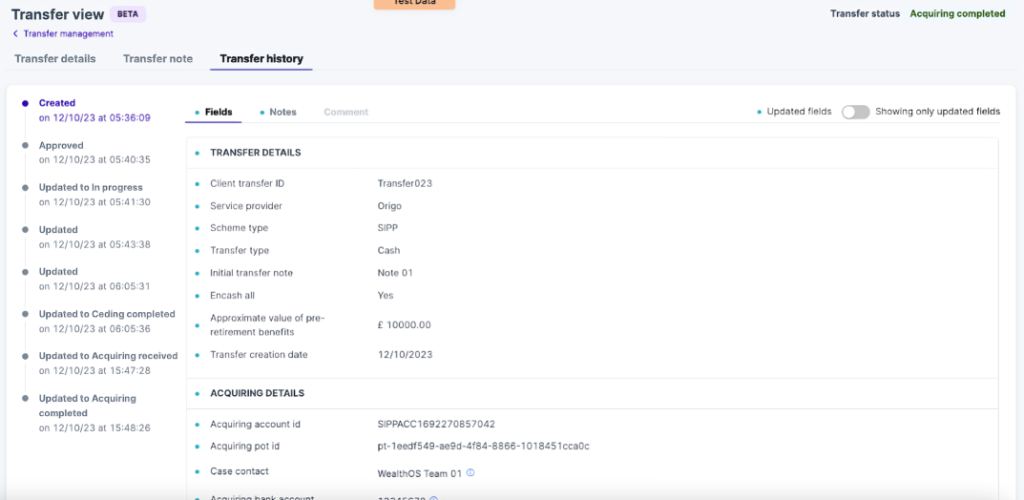

- Keeping everything on track–a single case management workflow that mirrors the different stages of a pension transfer. From transfer initiation, due diligence and information gathering, to confirmation or rejection of the transfer, requesting for cash or assets, receipt of cash or assets and updating of the client account

- Tools to perform tasks at each stage of the transfer–automated case creation and updates based on actions, secure document upload capability, chat functionality to securely communicate with pension providers and most importantly, a single place where all information pertaining to the transfer is maintained

- The necessary integrations out-of-the-box–with transfer messaging systems like Altus

- Automating updates–providing continuous updates via modern update emitting mechanisms like WebHooks and WebSockets to send text or email messages and keep clients updated

- Easy connectivity between systems–APIs to accept transfer instructions from digital portals, connectivity to record-keeping systems to update cash and asset positions and connectivity to banks and custodians to reconcile cash and asset receipts

WealthOS’ Unified Pension Transfer Manager also provides a delightful digital user experience to aid pension transfer admin teams.

We have already integrated with one of the leading transfer messaging services, which allows pension transfer admin teams to automatically send and receive updates to and from the transfer service provider without having to log in to its UI separately. This allows for a better user experience whereby teams can stay on a single screen to complete all their tasks.

Pensions are – in many cases – the largest asset an individual will have at any given point and it is incumbent upon all of us in this industry to treat it with the respect it is due. WealthOS is proud to be leading the charge on providing a frictionless and modern solution that any DC pension administrator can very easily adopt within their operating model to increase the efficiency of their transfer process immediately.

Interested? Get in touch with shri@wealthos.cloud to learn more or click here to book a demo with us.

- This article in the Pensions Expert provides a handy break down of the transfer times across the industry.

- It’s not all bad news as per this Origo press release – Pension Transfer times – don’t shoot the good guys. Origo, 2023, August 30 – technology is the deciding factor.